Free Retirement Calculator

A simplified version of Firebird's advanced planning tools

Free Version of our Retirement Calculator

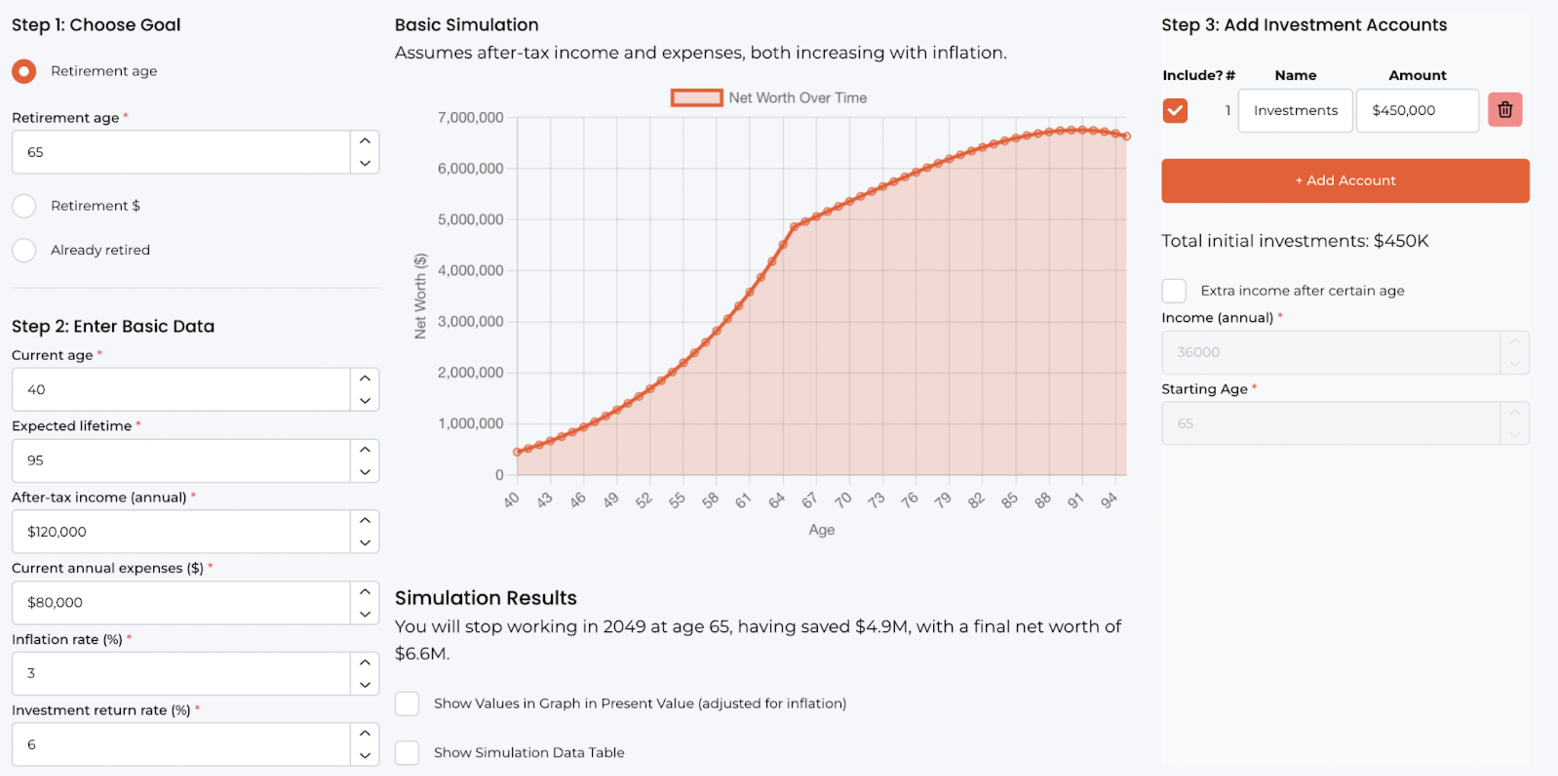

Firebird is in active development but it's not yet ready for public release. In the meantime, we've put together a simple retirement planning calculator. We haven't been satisfied with other free calculators online, so we're putting something here that we use ourselves.

This simple calculator doesn't do all the statistical simulations we're working on for the advanced version, but it may give you a good initial view of how long your money might last.

You can quickly answer questions like “What if I retire in 5 years? What about 10 years?” The graph will dynamically change as you update to a new figure.

Users should be aware that we do not retain any data entered in the Free Calculator. Everything works in your browser. This means we cannot show you your historical data and every time you come back, you will have to type everything again. (This feature will be available in the Premium Calculator!)

How to Use the Free Calculator

Step 1

Under Step 1: Choose Goal, you need to choose between 3 options:

- Retire once you hit a certain age

- Retire once you hit a certain amount of savings

- Retire now

How this affects the calculations:

- Once you retire, the calculator assumes your

After-tax income (annual)(under Step 2: Enter Basic Data) is zero and you will start withdrawing from your savings.

If you have another source of income that will not stop after you retire, fill out theExtra income after a certain ageunder Step 3

Step 2

Under Step 2: Enter Basic Data, you will provide the information and assumptions to the calculator like your current age, your expected lifetime, your current annual income, current annual expenses, (expected) inflation rate, and (expected) investment return rate.

How this affects the calculations:

- Your age and expected lifetime (along with your retirement age) will affect how long we will run your calculations. The more years you are in retirement, the more money you will need to live out of your investments.

- We assume that you will add X to your investment accounts, where X is current annual income - current annual expenses

- We assume your expenses will increase at the inflation rate

- We assume your investments will increase at the investment return rate

- If your income is lower than your expenses, we assume you will withdraw money from your investment accounts.

- For simplicity, we assume your investment account withdrawals are taxed at 15%

Step 3

Under Step 3: Add Investment Accounts, you can add as many accounts as you want (or you can manually add them up and only use one field). The main idea is to allow you to add and remove accounts easily with the checkmark button, so you can visualize how each account affects the calculations.

You can also add one source of income you might have in retirement, like your social security income, rental income, etc.

How this affects the calculations:

- Your extra source of income will start at the age you set it to start. This will be added to your total income, affecting your X added to investments to become

(annual income + extra income) - annual expenses.

Finally, we have 2 cool buttons under the graph. The first button makes the graph show the value adjusted for inflation, to make the amount interpretable in terms of today’s dollars.

The second button displays the data on a table, so you can visualize step-by-step, year-by-year, how your income, expenses, and investments are changing over time.

Conclusion

Even though this is a simple tool, we had a lot of good insights for ourselves and friends just by using it. We are excited about the Premium version, but we wanted to make this available now for people. Let us know what you think! Firebird Free Calculator.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.